When someone forms an LLC, one of the first confusing moments comes right after.

Do I use my SSN?

Do I need an EIN?

Are they the same thing?

On the surface, it feels simple. An LLC is a business, so it should use a business number. Right?

Not exactly.

The confusion happens because an LLC is a legal structure created at the state level. But SSNs and EINs are federal tax identifiers. And for tax purposes, the IRS doesn’t automatically treat every LLC the same way.

That’s where the difference begins.

What an SSN Actually Is

An SSN is a personal taxpayer identification number.

It identifies you as an individual for federal tax reporting. It’s tied to your income, your filings, and your identity as a person.

If you operate a business as a sole proprietor, the IRS sees you and the business as the same taxpayer. So your SSN is the tax identifier.

That’s where things start overlapping with certain LLC setups.

What an EIN Actually Is

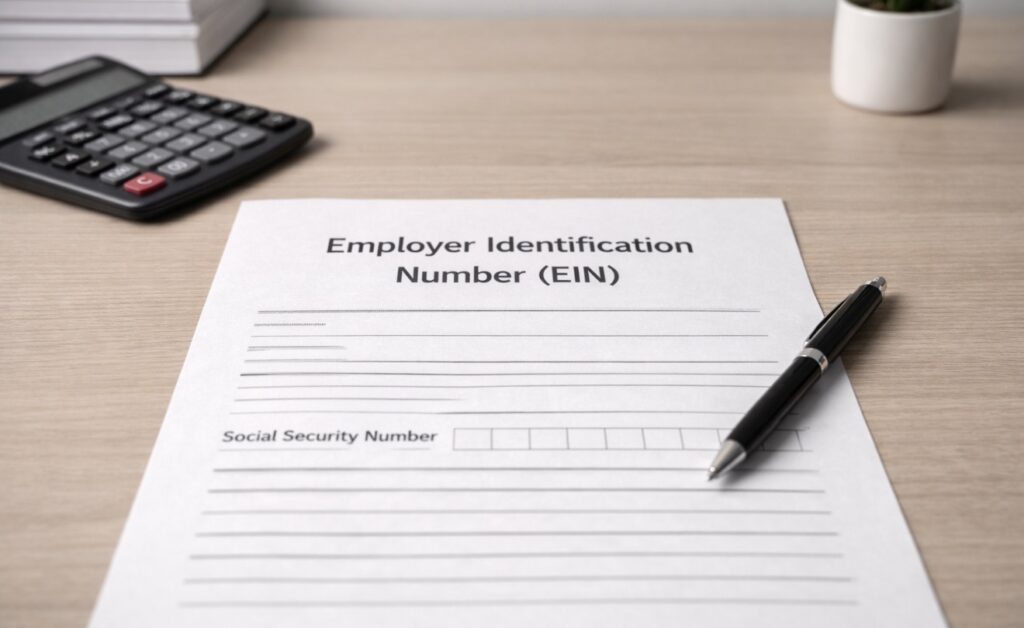

An EIN is a federal tax ID issued to identify a business entity.

It’s used for federal tax administration. Think employment taxes, business returns, certain reporting forms, and other filings tied to a business structure.

It doesn’t replace your SSN as a person. It identifies the entity.

But here’s the important part.

Whether an LLC uses an SSN or EIN depends on how the IRS treats the LLC for tax purposes.

The Part Most People Miss: Legal Structure vs Tax Treatment

An LLC is a state-level legal structure.

But for federal tax purposes, the IRS classifies it separately.

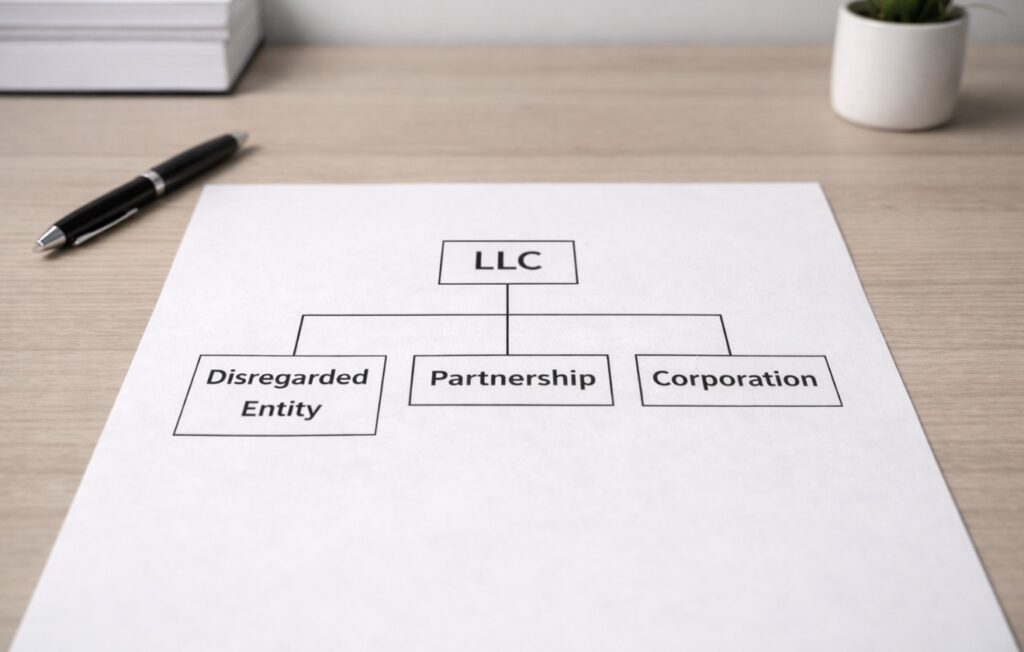

By default:

A single-member LLC is usually treated as a “disregarded entity.”

That means for federal tax purposes, the owner and the LLC are treated as the same taxpayer.

A multi-member LLC is generally treated as a partnership by default.

An LLC can also elect to be taxed as a corporation.

Those classifications determine which tax identifier shows up on federal forms.

Not the fact that it says “LLC” in your state documents.

When SSN Is Commonly Used

If an LLC is a single-member LLC treated as a disregarded entity, the IRS typically sees the owner as the taxpayer.

In that setup, certain federal forms may use the owner’s SSN because the income is reported directly on the owner’s personal return.

The LLC exists legally.

But federally, the taxpayer is still the individual.

That’s why people sometimes see their SSN used in connection with their LLC.

It’s not because the LLC isn’t real. It’s because of how federal tax classification works.

When an EIN Is Used

If the LLC has multiple members, or if it elects to be taxed as a corporation, the entity is recognized separately for federal tax purposes.

In those cases, the EIN is typically used for federal reporting.

An EIN is also commonly associated with situations involving payroll or formal business tax filings tied to the entity itself.

The key idea is this:

When the IRS treats the LLC as its own tax entity, the EIN becomes the identifier.

When the IRS treats the owner and LLC as the same taxpayer, the SSN may appear in certain filings.

The Privacy Confusion

A lot of people think the difference is about privacy.

It isn’t, at least not in the way people assume.

An EIN is not anonymity. It’s simply a different federal tax identifier. The IRS still connects it to the underlying entity and its responsible party.

The practical difference is usually about what number gets provided on reporting forms.

But the legal and tax identity behind it remains traceable through federal systems.

Why This Feels So Complicated

It feels confusing because people assume:

LLC equals business

Business equals EIN

But federal tax treatment doesn’t always follow that simple logic.

An LLC can exist legally while still being treated like an individual for federal tax purposes.

And that’s why the SSN vs EIN question even exists.

Final Thoughts

The difference between SSN and EIN for an LLC isn’t about which one is “better.”

It’s about how the IRS classifies the entity for tax purposes.

State-level structure and federal tax identity are not the same thing.

And once you understand that separation, the confusion starts to fade.

The real question isn’t “Do I have an LLC?”

It’s “How is this LLC treated for federal taxes?”

That’s what determines which number shows up.

Leave a Reply