When people think about investing, they usually get stuck on

what to invest in.

Stocks or real estate. Index funds or individual companies. Growth or value.

That stuff matters, but it’s not the biggest factor.

The real driver of long-term investing is time, and most people seriously underestimate how much it matters.

That misunderstanding doesn’t feel dramatic in the moment. But over years, it quietly costs people growth, money, and sometimes entire financial goals.

Our Brains Don’t Naturally Understand Compounding

Humans aren’t wired to think in exponential terms.

We think linearly. If something grows a little this year, we expect roughly the same thing next year. Investing doesn’t work like that.

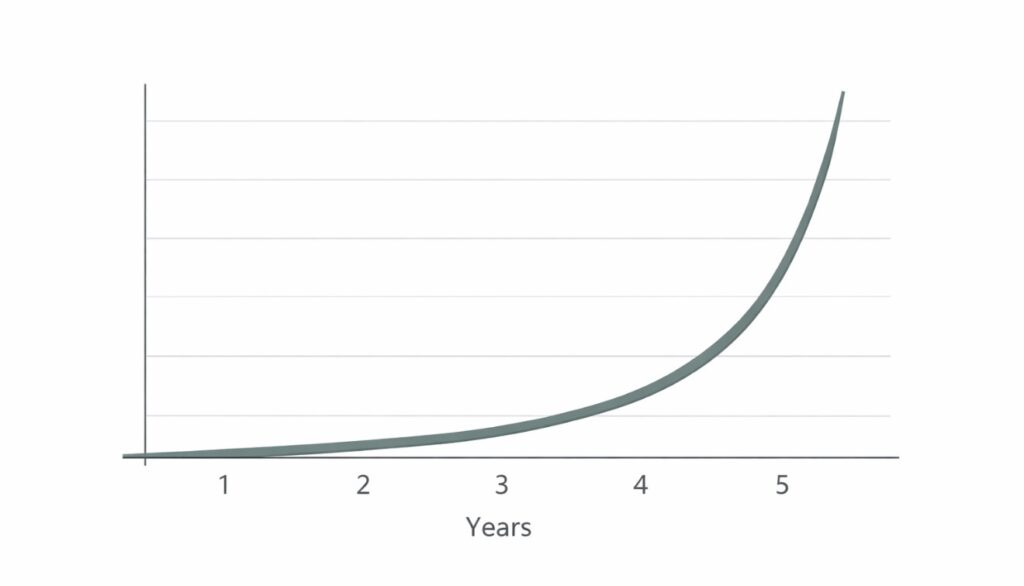

With compounding, your gains start producing gains of their own. Early on, it feels slow. Almost pointless, honestly. You invest for years and it doesn’t look like much is happening.

Then, over longer periods, the growth starts stacking on itself.

That’s why investing for 30 years isn’t just “three times better” than investing for 10. It can be dramatically better, even with average returns.

Most people don’t feel that difference intuitively, so they underestimate how powerful staying invested for longer actually is.

The Future Feels Smaller Than It Really Is

Another issue is present bias.

We care far more about today than some vague version of ourselves decades from now. Investing feels like giving something up now for a reward that doesn’t feel real yet.

So people put it off.

“I’ll start next year.”

“I’ll invest more once I earn more.”

“I’ll wait until things feel safer.”

Each delay feels harmless. But time lost doesn’t come back, and those missing years compound just like money does.

Short-Term Noise Shrinks Long-Term Thinking

Markets move constantly. Prices swing, headlines panic, and every week there’s a new reason to feel nervous or excited.

When people watch their investments too closely, they start thinking short term, even if their goals are decades away.

That’s when mistakes happen:

• Selling during downturns

• Waiting on the sidelines too long

• Jumping in and out based on headlines

Ironically, the people who benefit most from long-term investing are usually the ones who pay the least attention to short-term movement.

Staying Invested Is Harder Than It Sounds

On paper, long-term investing looks easy.

In real life, it isn’t.

Market crashes, recessions, and long stretches where nothing seems to happen test people’s patience. Fear, doubt, and second-guessing push people to act when doing nothing would’ve been better.

Time only works if you actually stay invested long enough to let it work.

Waiting for the “Right Time” Quietly Wastes Years

A lot of people sit in cash waiting for the perfect moment to invest.

The problem is that waiting doesn’t feel like a loss. There’s no immediate pain. But the opportunity cost adds up quietly in the background.

Missing just a few strong periods early on can permanently drag down long-term results. And those periods are almost impossible to predict ahead of time.

In the long run, being early matters far more than being precise.

Time Amplifies Mistakes Too

Time doesn’t just magnify gains.

Small fees, minor tax inefficiencies, and emotional decisions might not seem like a big deal year to year. Over decades, they compound in the wrong direction and eat away at returns.

That’s another way people underestimate time. They don’t realize it works against them just as efficiently as it works for them.

Time Is the Real Advantage

You don’t need perfect timing.

You don’t need secret strategies.

You don’t need to beat the market every year.

You need time, and the discipline to respect it.

Long-term investing rewards patience, consistency, and emotional control far more than clever moves. People who understand that early end up with an advantage that’s hard to catch up to later.

Final Thoughts

Most investing mistakes aren’t about picking the wrong thing. They’re about misunderstanding time.

Time feels slow.

Compounding is invisible at first.

And the future feels far away.

But in long-term investing, time is the thing that turns ordinary decisions into meaningful results. The sooner you stop underestimating it, the more it works in your favor.

Leave a Reply